unemployment tax refund update 2021

More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming The IRS reported that another 15 million taxpayers will. TAS Tax Tip.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

The American Rescue Plan pandemic relief bill switched up the law so that people who collected.

. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. The American Rescue Plan made it so that up to 10200 of unemployment benefit received in 2020 are tax exempt from federal income tax. The income threshold for.

Irs unemployment tax refund august update. IRS will start sending tax refunds for the 10200 unemployment tax break Fourteen states will end additional unemployment benefits in June How much can you be. The irs is recalculating refunds for people whose.

File 2021 Tax Return. IR-2021-159 July 28 2021. Taxrefund taxreturn unemployment stimulusIn this video we discuss the exact date you will see your refund based upon the date your refund was accepted--.

22 2022 Published 742 am. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on.

The most recent batch of unemployment refunds went out in late july 2021. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller.

We will begin paying ANCHOR benefits in the late Spring of 2023. Dont expect a refund for unemployment benefits. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a.

This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act 1 and. The deadline for filing your ANCHOR benefit application is December 30 2022. ANCHOR payments will be.

Unemployment Tax Refunds More Checks Heading Out This Weekend The National Interest

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

What You Should Know About Unemployment Tax Refund

Irs Correcting Tax Returns Issuing Refunds On Unemployment Income Exclusion Njbia

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

Irs Unemployment Tax Refund Update More July Payments

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Tax Day 2021 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

I Got My Refund News Is Not All Bad Welcome C35 Club 3 5 Facebook

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Irs Still Sending Unemployment Tax Refunds

Unemployment Tax Refund Advice Needed R Irs

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Guide To Unemployment Taxes H R Block

Irs Unemployment Tax Refund Taxpayers Frustrated By Tracking Issues Slow Pace Of Payments The Hemet San Jacinto Chronicle

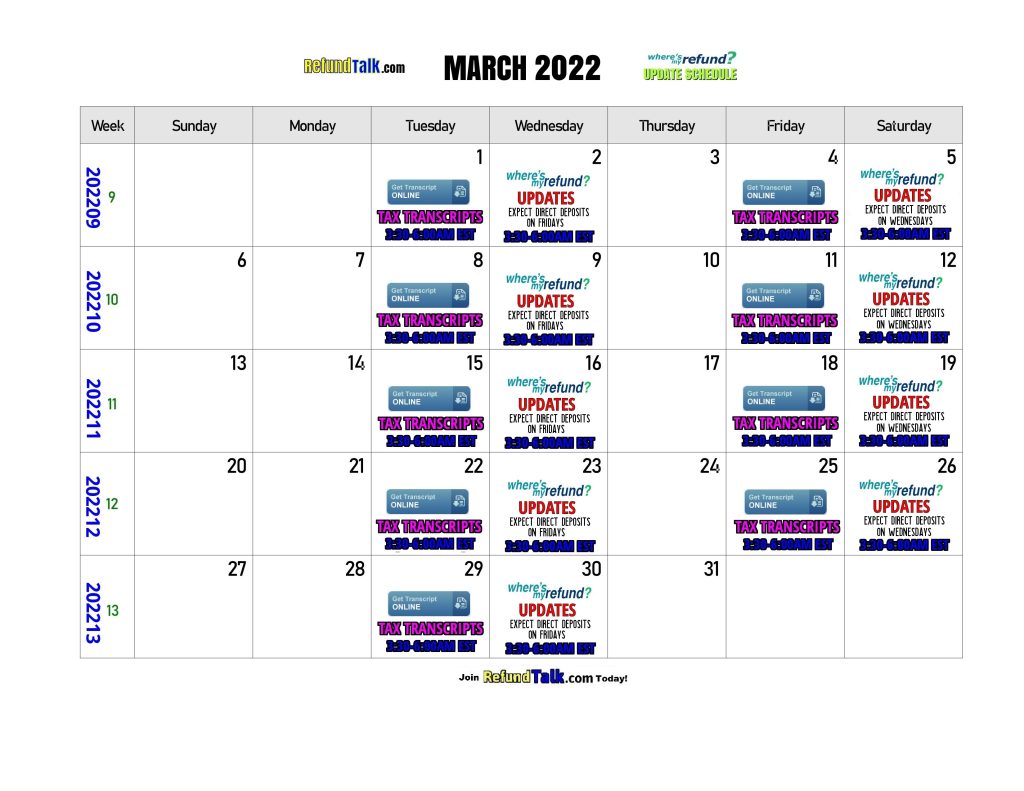

Tax Refund Updates Calendar Where S My Refund Tax News Information

Confused About Unemployment Tax Refund Question In Comments R Irs